Intergovernmental Relations

The term “intergovernmental relations” (IGR) was invented in the 1930s as a phrase unique to the United States. It was a novel concept aimed at summarizing the extensive and varied growth in relationships among the thousands of local, state, and national governing entities, as well as among the many officials holding important policy-making posts. William Anderson, widely credited with originating the concept, devoted two chapters formally titled “Intergovernmental Relations” in his comprehensive (fifty-two-chapter) American Government textbook (1938), with chapter subtitles labeled (1) “National-State and State-Local,” and (2) “Interstate and Interlocal.”

Years later, Anderson (in Intergovernmental Relations in Review [1960]) offered a provisional definition of IGR, stating that it “has become accepted to designate an important body of activities or interactions occurring between governmental units of all types and levels . . . it is human beings clothed with office who are the real determiners of what the relations between units of government will be, consequently the concept necessarily has to be formulated largely in terms of human relations and human behavior under the conditions that prevail when different people represent the interests of different units and different functions of government.”

Anderson’s initial conceptualizations and subsequent research and writings solidly established IGR in several respects. These encompassed (1) a subject for systematic study, (2) a watershed for wide-ranging policy research, (3) a topic/title for college-level courses, (4) a phrase acceptable to a broad range of public officials, and (5) a term subsequently incorporated into statutory law (P.L. 83-109; P.L. 86-380).

The first law, passed in 1953, created the temporary (1953–55) U.S. Commission on Intergovernmental Relations whose summary and multivolume reports were issued in 1955. The second legislation authorized in 1959 the presumably permanent Advisory Commission on Intergovernmental Relations (ACIR). For more than three decades this body generated regular and extensive studies and policy recommendations on IGR. An intergovernmentally representative commission, the ACIR was the premier and definitive policy research entity on IGR until political polarization around its recommendations, especially involving unfunded national mandates, caused it to lose congressional financing in 1996.

From the above early intellectual rivulets and subsequent statutory streams has come a broad river of research, analyses, and recommendations on policies and practices flowing across three-quarters of a century. These extensive efforts have produced the present features and current patterns that now characterize IGR.

We may extract from Anderson’s 1960 definition the following three features to specify and elaborate the central characteristics of IGR. These are (1) governmental units of all types and levels, (2) different types of people/officials, and (3) diverse functions and financing of governments. In the process of discussing these features, the contrasts between IGR and federalism will become apparent. Likewise, a distinction between IGR and intergovernmental management will be indicated (Wright 1990; Wright and Stenberg 2005).

Contents

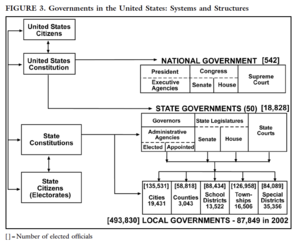

IGR AND FEDERALISM: DIFFERENT GOVERNMENTAL UNITS

The origin, emergence, and maturity of IGR occurred within the context of American federalism, especially as IGR was further refined by Anderson and elaborated by Elazar (1962). Both historically and institutionally, federalism placed emphasis on nationalstate relationships and secondarily on interstate relations. By way of contrast, IGR encompasses all the combinations and permutations of interactions among more than 87,000 units of government present within the American political system. Therefore IGR involves state-local, interlocal, national-local, interstate, and state-national interactions. Figure 3 depicts federalism as it relates to constitutional governance and electoral arrangements establishing formal institutional relationships between the nation and the states.

Figure 1 also reveals the greater inclusiveness of IGR when state-local and interlocal relationships are added. Nearly 88,000 legally constituted units of government are operating entities engaged in IGR to a greater or lesser degree. Moreover, the brackets in Figure 1 contain numbers indicating the frequency of popularly elected local, state, and national officials in the respective types of jurisdictions. (The 1992 numbers are the most recent ones available.) This massive number of popularly elected state and local officials emphasizes how politically diverse and decentralized IGR are in the United States. In addition, the number of full-time public employees further highlights the heavy noncentralized character of the IGR system. The 2002 employment numbers in millions are as follows: national, 2.6; state, 4.9; and local, 12.3. These arrays of elected officials and employment numbers turn attention to Anderson’s emphasis on IGR as the interactions among different types of officials.

THREE TYPES OF IGR ACTORS

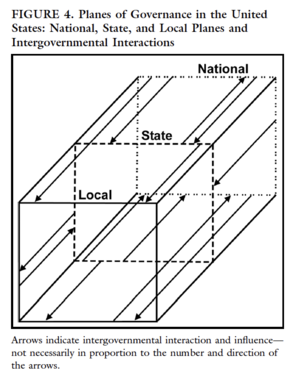

A second figure provides a transition toward identifying three main categories of officials prominent in IGR. Figure 4, a rectangular three-dimensional cube, displays visually several arrows showing illustrative paths of interactions among three main planes of governance—national, state, and local. (Interlocal and interstate interactions, because of their frequency and intensity, are omitted for the sake of simplicity and clarity.) Note the presence of upright planes from which interactions involving influence and authority are launched and received. These planes are not “levels” positioned in a presumed hierarchical or superior-subordinate relationship.

Two points follow from Figure 4. First, the extent of asymmetry or equality in influence across the planes is problematic, not automatic or preordained. Second, the arrows running in reciprocal directions among planes represent influence mobilized by officials, not units. Relevant here is my observation in Understanding Intergovernmental Relations: “strictly speaking, then, there are no relationships among governments; there are only relations among officials who govern different units” (Wright 1988; italics in original).

At the risk of oversimplification, it is useful to identify three main types of governance actors filling three important roles in IGR. These actors are the following:

1. Popularly elected generalists (PEGs): officials, both part-time and full-time, whose claim to the exercise of public authority is based upon their popular election to the position they occupy.

2. Appointed administrative generalists (AAGs): officials, almost always in full-time roles, whose status and authority derive from the direct (or proximate) appointment by the governing board/body of a governmental entity.

3. Program policy professionals (PPPs): full-time managers of programs or functions (such as departmental directors) whose access to positions of authority is chiefly through professional education and extensive experience in a career specialty, program function, or particular policy.

These three sets of officials occupy crucial and contrasting roles in the implementation of intergovernmental programs. The prominent connection between IGR and policy implementation was confirmed by Kettl (1993, 313) who noted, “Nearly 80 percent of all entries for programs and organizations in one implementation textbook are for programs and organizations that have an important intergovernmental dimension.” The IGR roles of these actors can be understood better by starting with a description of the position of PPPs.

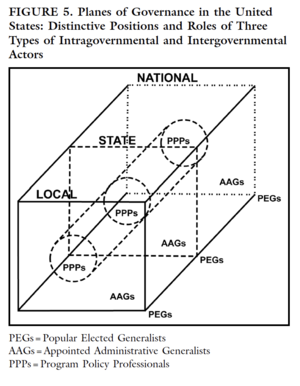

Program policy professionals are located in Figure 5 (a) at the center of the three respective planes, and (b) within the cylindrical core that penetrates and connects the national, state, and local planes. Anyone familiar with the origins and growth of federal aid across the twentieth century can readily and correctly deduce that this core figuratively contains the conduits for 700-plus grant-in-aid programs that channel money from the national to state and local governments. The PPPs are especially experienced and skilled in administering over 700 hundred categorical (and about 20 block) grant programs that move these funds across the planes of governance.

In the aggregate, the PPPs are commonly referred to as “specialists,” based on their career specialization experiences. They are also the actors who are at the center of what is termed program or intergovernmental management. These specialists and the grant-in-aid conduits that they manage represent, individually and collectively, what is commonly called picket fence federalism.

Specialists are regularly contrasted with PEGs and AAGs, who are commonly grouped together as “generalists.” The two types of generalists, however, operate in distinctly different settings, as can be inferred from Figure 5. The elected generalists, through their popular base, are democratically accountable and responsible officials in their respective jurisdictions. They make authoritative decisions and set policies implemented within and between planes. It falls to the AAGs to interpret, oversee, and assure that those decisions and policies are understood and followed by the PPPs, as well as the thousands (or millions) of other appointed administrators who operate within and between the multiple planes of governance. AAGs are “specialists in things in general,” whose essential role is bridging the gap and coordinating the connections between PEGs and PPPs.

IGR FINANCES AND FUNCTIONS

No discussion of IGR would be complete without recognition of the scope and significance of funding the functions of government. There are, of course, two components of the intergovernmental fiscal ledger. One involves revenue sources, while the other reflects expenditure decisions.

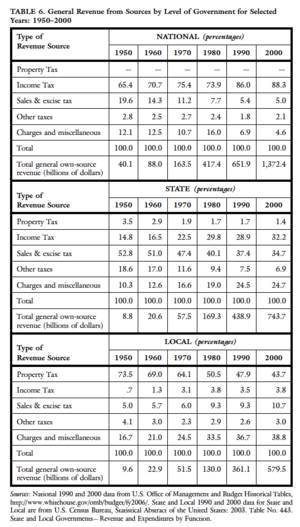

On the revenue side, there is some specialization but considerable overlapping in the primary sources of revenues raised by national, state, and local governments. Income taxes constitute the chief revenue source of the national government, producing more than 80 percent of all collections. The states have historically relied primarily on sales/excise taxes. In recent decades, however, income taxes have become a major supplementary source so that sales and income taxes each furnish about one third of state own-source revenues. Finally, the property tax remains a prominent if not predominant source of local revenue. Its importance over the past half century has declined as many local governments, especially cities and counties in several states, have secured statutory authority to levy sales and income taxes. These observations about the relative reliance on different revenue sources are supported by the percentages reported in Table 6.

Table 6 provides a long-term overview of the own-source revenue structures of national, state, and local governments. With one exception, the percentages for the major revenue sources from 1950 to 2000 fit the general patterns described above. The obvious departure is the consistent rise in reliance on charges/fees by local and state governments. This trend, often called “fee fever,” is most obvious for local governments, who now secure nearly as much revenue from fees and charges as from the property tax. Similarly, state governments have substantially increased their reliance on this non-tax source of revenue.

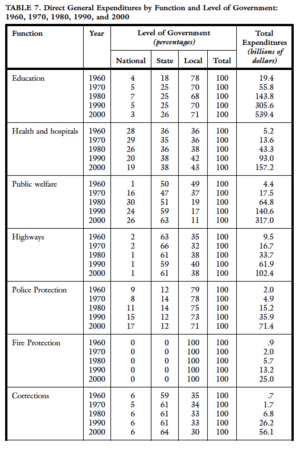

The expenditure side of the fiscal ledger also reveals the diversity with which different governmental entities spend in support of nine major public functions. Table 7 displays percentages showing the relative responsibilities in direct spending for those public programs from 1960 to 2000. Aggregate dollar outlays (in billions) are reported for the initial year of each decade.

Education, health/hospitals, and welfare are clearly the big three in total public expenditures. Outlays for these purposes have increased almost exponentially from 1960 to 2000. Percentages in Table 7 show that the relative roles in spending by the different governmental levels vary considerably, not only for the three major functions but also for the other six activities. Education, police, and fire protection are clearly local functions, while welfare, highways, and corrections expenditures are chiefly the operational responsibility of state governments. Only for housing/urban renewal and air transportation does the national government directly spend a substantial proportion of public outlays.

Further discussion is merited by the dominance of different planes of government in spending for various purposes. It should be emphasized that the percentages reported in Table 7 are for direct outlays and do not reflect intergovernmental expenditures. They do not reveal, for example, the fact that in 2000 the fifty state governments channeled over $200 billion in intergovernmental education aid to local school districts. Those funds, spent by the local units, are reflected in the 71 percent figure in Table 7. If state educational aid was counted as state expenditures, the 26 percent shown in Table 7 would exceed 60 percent of all public education outlays and the local percentage would drop to around 35 percent.

For public welfare, federal aid of nearly $150 billion went to the states in 2000. If counted as national rather than state outlays, the state percentage would drop to about 20 percent and the national figure would approach 70 percent. Similar noteworthy but varied adjustments in percentages for health/hospital and highways in Table 7 would be required if intergovernmental transfers were factored into the calculations. These revised figures reflect the fact that federal and state fiscal transfers result in different planes financing a significant share of the costs for major public programs, although they do not actually deliver the services. Fiscal complexity and interdependency are fundamental facts of IGR.

CONCLUSION

The American system of governance is really an aggregation of numerous sets of governmental systems. IGR reflects these systems within systems. The concept was invented, and emerged and matured, as a phrase intended to capture these complex realities. IGR encompasses elaborate institutional arrangements, numberless actors (officials) in diverse roles, and immensely significant fiscal and functional responsibilities. These features describe highly differentiated yet intensely interdependent patterns of relationships among thousands of governing entities. Conscious awareness and a solid understanding of IGR are necessary conditions for gaining a firm grasp on the character and content of American federalism and overall governance in the twenty-first century.

| BIBLIOGRAPHY:

William Anderson, American Government (New York: Henry Holt, 1938); William Anderson, Intergovernmental Relations in Review (Minneapolis: University of Minnesota Press, 1960); Daniel J. Elazar, The American Partnership: Intergovernmental Cooperation in the Nineteenth-Century United States (Chicago: University of Chicago Press, 1962); Donald F. Kettl, “Public Administration: The State of the Field,” in Political Science: The State of the Field, ed. Ada W. Finifter, 407–28 (Washington, DC: American Political Science Association, 1993); Deil S. Wright, Understanding Intergovernmental Relations (Pacific Grove, CA: Brooks Cole, 1988); and Deil S. Wright and Carl W. Stenberg, “Federalism Intergovernmental Relations, and Intergovernmental Management: The Origin, Emergence, and Maturity of Three Concepts across Two Centuries of Organizing Power by Area and by Function,” in Handbook of Public Administration, 3rd ed., ed. Jack Rabin (New York: Marcel Dekker, 2005). |

Deil S. Wright

Last updated: 2006

SEE ALSO: Intergovernmental Management; Picket Fence Federalism; U.S. Advisory Commission on Intergovernmental Relations